Blog

5 Business Organisations in Sri Lanka: Types & Benefits

2 Aug 2024

Selecting the right business structure is very important for any person who intends to start a business in Sri Lanka. It affects areas such as taxation, liability and even the ability to raise capital within the business. This article will give a brief description of the various types of Business organisations in Sri Lanka, and their advantages and disadvantages to enable the reader to make the right decision.

Types of Business Organisations in Sri Lanka

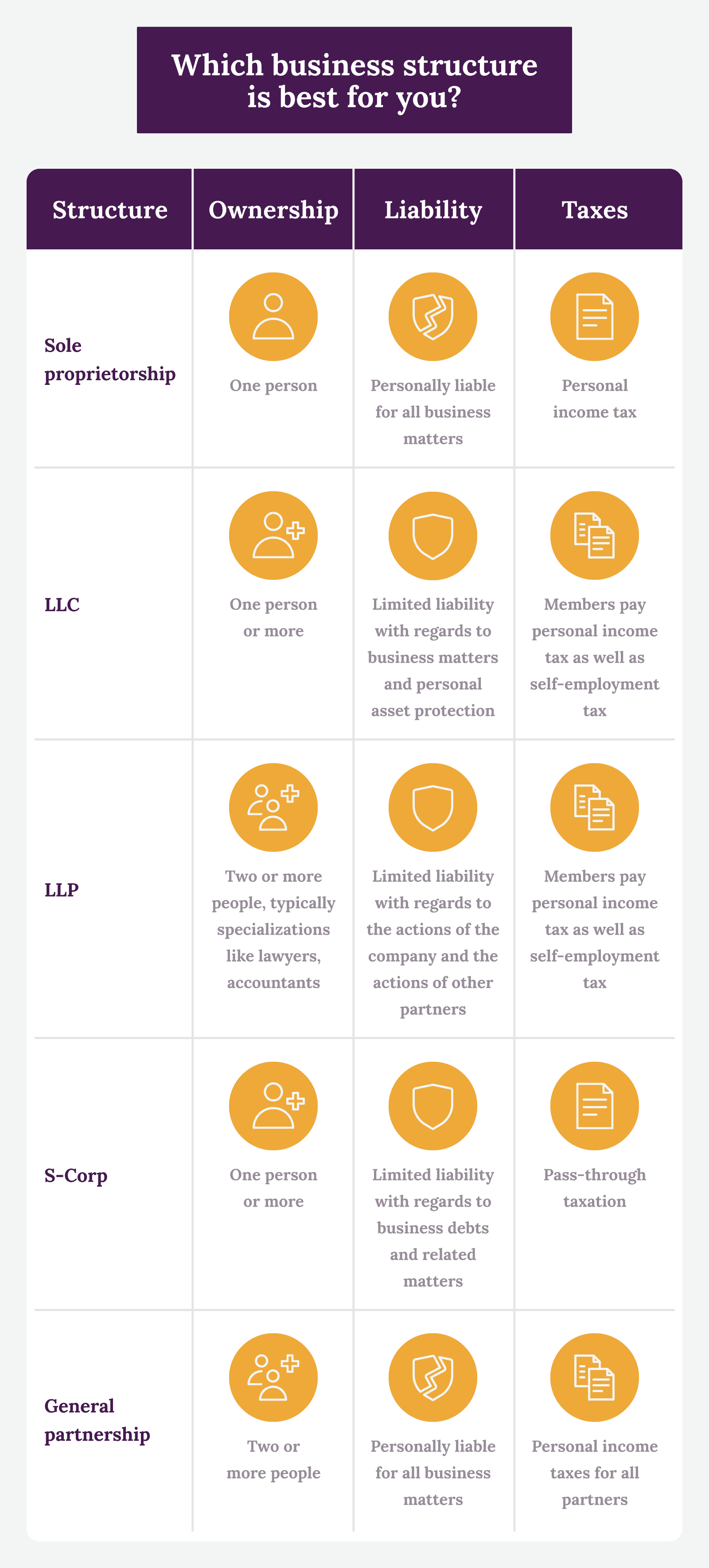

Image via, simplifyllc.com

There are several forms of business organisations in Sri Lanka and each of them has its own regulations and characteristics. It is crucial to understand these business types in Sri Lanka to choose the most appropriate one for your business.

Related: How to Start a Business in Sri Lanka: The Ultimate Reference

1. Sole Proprietorship

A Sole Proprietorship in Sri Lanka is the most basic and frequently used business structure. It is a one-person enterprise where the owner and the business are legally one and the same. This means that the owner has complete management and decision-making power over the business but is also personally responsible for all the business debts and legal suits.

Benefits of a Sole Proprietorship

Easy to Start: A sole trader is easy to establish and does not need a lot of capital to start with.

Control and Flexibility: The owner has full control over the company and can make changes as and when they are required.

Privacy: It has fewer legal requirements in terms of reporting and compliance compared to other business entities.

Retain Profits: The owner has full control of all the profits made by the business.

Drawbacks of a Sole Proprietorship

Unlimited Liability: The owner’s personal assets are exposed to loss in the event that the business accumulates debts or is involved in a legal case.

Difficulty in Raising Capital: Sole traders have limited ways of sourcing capital since they cannot declare shares.

Lack of Continuity: The business is often closed when the owner dies or when he or she decides to stop the business.

Unstable Taxes: Taxes at first may seem easy to handle but they can be a problem as the business expands.

Related: How to Register an Individual Business in Sri Lanka

2. Partnership

Partnerships have also got an important place in the economy as one of the types of business organisations of the private sector. The freedom of business people to carry out business activities in groups as opposed to individually has been a key factor that has led to the formation of partnerships. It is a form of business where two or more people come together to carry out a business venture and they all agree to divide the profits and losses.

Benefits of a Partnership

Easy to Set Up: Like a Sole Trader, Partnership is easy to establish and does not need much capital investment.

Shared Control and Management: In this case, partners are involved in the management of the business and they work together in terms of their abilities.

Shared Responsibility: The responsibilities of the business are shared among the partners, hence the management becomes easier.

Easier to Raise Capital: When there are many partners, there are more possibilities for getting funds from different sources.

Drawbacks of a Partnership

Unlimited Liability: In a Partnership, all the partners are jointly and severally liable for the business obligations and legal problems.

Lack of Continuity: The business can be disrupted if a partner leaves or dies.

Partner Conflicts: Conflict between the partners may impact the business.

Joint Liability: The partners are jointly and severally liable for the actions of the other partners, which exposes personal assets to risks.

3. Private Limited Company

A Private Limited Company is one of the most commonly used business structures for small to medium enterprises in Sri Lanka. It is an independent legal entity from its owners, thus affording its owners limited liability. A vast majority of the Startups in Sri Lanka begin with Private Limited Companies.

Benefits of a Private Limited Company

Limited Liability: The owners are only responsible for the amount of money they have invested in the company and their other assets are safe.

Professional Status: The company structure also helps in increasing the credibility and professionalism of the business.

Protection: The name of the company has legal status.

Less Reporting Obligations: Compared to Public Companies they have fewer disclosure obligations.

Drawbacks of a Private Limited Company

Higher Compliance: Legal and regulatory formalities are more compared to Sole Proprietorships and Partnerships.

Accounting and Bookkeeping: Accounting and auditing are compulsory and There are specific guidelines that must be adhered to when it comes to handling any financial issues.

Limited Capital Raising: It means that shares cannot be sold in the market and this restricts the possibility of attracting investments.

Limited Share Transferability: Restrictions on transferring shares can make changes in ownership more difficult.

4. Public Limited Company

A Public Limited Company can issue its shares to the public, which is a way of raising a large amount of capital. However, it is accompanied by strict rules and regulations as well as high levels of transparency.

Benefits of a Public Limited Company

Limited Liability: Like in Private Companies, legal responsibility is restricted to the capital put by the shareholders.

Raising Capital: The possibility of selling shares on the stock market is a good way to attract a large amount of capital.

Transferability of Shares: It is easy to buy and sell shares which makes it liquid.

Drawbacks of a Public Limited Company

Expensive Process: The process of going public is costly.

Transparency Requirements: They have extensive disclosure and reporting requirements.

Share Value Dependent on Market: Market perceptions affect company value.

Strict Regulations: It can be challenging to meet strict regulatory requirements.

5. Company Limited by Guarantee

A Company Limited by Guarantee is usually applied for by non-profit organisations. Instead of Shareholders, It has members who agree to contribute to the assets of the company in the case of winding up of the company according to the terms set out in its articles.

Benefits of a Company Limited by Guarantee

Separate Legal Entity: Safeguards personal property of members.

Limited Liability: Members are only responsible to the extent of the amount they agreed to contribute.

Trustworthiness: Improves credibility, especially for non-governmental organizations and non-profit organizations.

Tax Concessions: May be eligible for tax deductions depending on the type of operations.

Drawbacks of a Company Limited by Guarantee

Strict Registration Criteria: It has to meet certain legal conditions.

High Registration Cost: Costs more to register than other business types.

Strict Operational Criteria: Has to follow strict rules to sustain the status and work legally.

Choosing the Right Business Type

When deciding on the types of business in Sri Lanka for your business idea, consider the following factors:

Number of Owners or Partners

Sole Proprietorship: Best if you are the only owner.

Partnership or Company: Appropriate if you have several owners or if you are going to attract investors to your business.

Capital Investment

Sole Proprietorship: Self-financed from personal savings.

Companies: It can issue shares (Private or Public) to get capital.

Liability

Sole Proprietorship and Partnership: Owners' personal assets are at risk.

Private and Public Companies: Offer limited liability protection.

Taxes

Sole Proprietorship: Tax on Individual’s Profit

Companies: Taxed on Net Profit.

Conclusion

It is important to have knowledge of the various types of business organisations in Sri Lanka to be able to make the right decision depending on the business plan. Both structures have their advantages and disadvantages and therefore it is important to consider the circumstances of the business.

For personalised consultation and help with the registration of your business as a Private Limited Company take advantage of our Free consultation. Our experts will assist you in registering your company and make sure it begins on the right note.