Blog

EPF and ETF in Sri Lanka: Secure Your Retirement Today

2 Sept 2024

Employers and employees in Sri Lanka need to understand the differences between the Employees’ Provident Fund (EPF) and the Employees’ Trust Fund (ETF). These two social security schemes are very crucial in ensuring that workers have adequate financial resources in their retirement and cases of need.

While the EPF is mainly concerned with offering retirement benefits through employer and employee contributions, the ETF provides other welfare benefits without the employees’ contributions. This article goes further to explain the details of EPF and ETF, the requirements for joining, how to register, how to contribute and how to claim, making it a one-stop guide to understanding these important financial security measures.

First, take a look at the EPF.

Employee Provident Fund (EPF)

The Employees’ Provident Fund (EPF) is the largest social security organisation in Sri Lanka which has been established under the provision of the Employees’ Provident Fund Act. No. 15 of 1958. Originally conceived for employees in the private sector, state-sponsored corporations, statutory boards, and private businesses, the EPF has the responsibility of providing for the financial needs of an employee during his or her post-retirement stage.

The EPF also makes sure that the employees and employers make contributions towards the fund with the employees contributing not less than 8% of their monthly wages and the employers contributing not less than 12%. These contributions are then used to fund more secure forms of investments for their growth over the long term, thus providing a good financial security net for the employees after they retire.

The administrative responsibilities of EPF are under the discretion of the Commissioner of Labour while the management responsibility lies in the Central Bank of Sri Lanka (CBSL). The EPF department of the CBSL is involved in the receipt of contributions, keeping and recording the accounts of the members, investment of funds and payment of benefits to the members on retirement.

However, like any other retirement benefit organisation, the EPF provides pre-retirement facilities such as housing loans and partial withdrawals for housing or medical purposes. This ensures that the EPF is available to cater for an employee during his or her retirement period as well as enable him or her to accomplish other vital aspects in his or her lifetime other than working before retiring.

As a result of the complete structure and the provision of two-fold benefits, EPF continues to be the financial companion of the employees in Sri Lanka towards a prosperous retirement.

Eligibility for EPF

The EPF is meant for most of the private sector employees to ensure that they are economically productive in their retirement age. Nevertheless, the EPF does not apply to all employees. Section 8 of the EPF Act No. 15 of 1958 states that there are some categories of employment which are exempted from the provisions of contributing to the EPF.

The following groups are not considered "Covered Employment" under the Act:

Government employees

Employees registered under the Local Government Service Commission\

Family business operators

Employees of charitable organisations with fewer than 10 employees

The establishment is a social service organisation providing technical training for minor offenders, destitute, deaf and blind.

The household employees

For all other employees who do not belong to these categories, the EPF contributions must be credited in compliance with the Act. Employers and employees who fall within the covered employment scope are legally bound to make contributions as stipulated by the law. Understanding this distinction is essential for both employers and employees to ensure compliance with EPF regulations and to secure the intended retirement benefits for eligible workers.

Thus, if the business is identified as covered employment, the employer must register his business with the nearest labour office. To do the registration, the employer has to perform the tasks as follows.

EPF Registration for Employers and Employees

Registering with the Employees’ Provident Fund (EPF) is a crucial step for both employers and employees to ensure compliance with legal requirements and secure retirement benefits. The process for registration differs for employers and employees and involves submitting specific forms and documents.

For Employers

Employers are obliged to report their business to the Labour Department within two weeks after the hiring of the first employee. This includes filing of what is referred to as “Form D” in duplicate, certified and posted through registered post to the nearest Labour Office or the Commissioner of Labour in the area.

Required Supporting Documents:

Two original copies of the completed “Form D.”

Form D Submission:

For businesses with 10 or fewer employees, submit two certified copies of the “Form D” annexure with an official seal.

For businesses with more than 10 employees, provide a detailed list that includes each employee’s full name, age, nature of employment, wage, and appointment date.

Certification of “Form D” and annexures should be done by the business owner or a partner. If someone else signs, a power of attorney is required.

Explanation Letter: If the request for EPF registration is made more than two years after the business's commencement, provide a written explanation.

Additional Documentation Based on Business Type:

Sole Proprietorship: Photocopy of the Business Registration certificate and the owner’s National Identity card.

Partnership Business: Photocopy of the Business Registration certificate and National Identity cards for all partners.

Limited or Private Limited Company: Certified copy of the Business Registration certificate or certificate of incorporation and relevant forms (Form 01, 05, 20, or 40) listing board information.

Foreign Company: Business Registration certificate or certificate of incorporation, Form 44, 45 and 46, and National Identity card or passport of the person with power of attorney.

Government-Linked Projects: DMR approvals, treasury approvals and appointment letters as approved by the Department of Management Services.

For Employees

To join the EPF, employees are required to fill in and sign the form “ABH” which has to be endorsed by the employer and the same has to be forwarded to the district labour office within one month of joining the service. The form should be completed and should be accompanied by a copy of the employee’s National Identity card.

This simple registration process makes it possible for both the employers and the employees to meet their legal requirements while at the same time getting an opportunity to enjoy the benefits of the EPF such as the retirement funds and other pre-retirement amenities.

Methods of Paying EPF Contributions

Like any other EPF contribution, it is the responsibility of the employer to ensure that the contributions are made on time and are accurate. Originally, such payments were made through filing Form C accompanied by a cheque. But, with the introduction of digital banking the Central Bank of Sri Lanka encourages online payments in a better and more efficient way.

The process starts with the registration of the employer which can be done directly at the EPF Department or through a licensed commercial bank in Sri Lanka. After registration, employers can input contribution information and make payments through banking facilities. This digital approach makes the payment process less complicated and tracking of contributions is also made easier.

Notably, although the online payment option is open to all employers, it is compulsory for employers with 50 employees and above. The change to online filing not only guarantees adherence to the regulations but also increases the accuracy of the reports and eliminates time-consuming paperwork.

Integrating online payments into the EPF system helps employers find a solution that is convenient for them, and also contributes to the development of the Central Bank’s proposal to improve the efficiency of EPF contributions. This method is gradually being adopted by many business organizations and the outcome is that both the employer and employee get a better and faster way of handling the retirement fund.

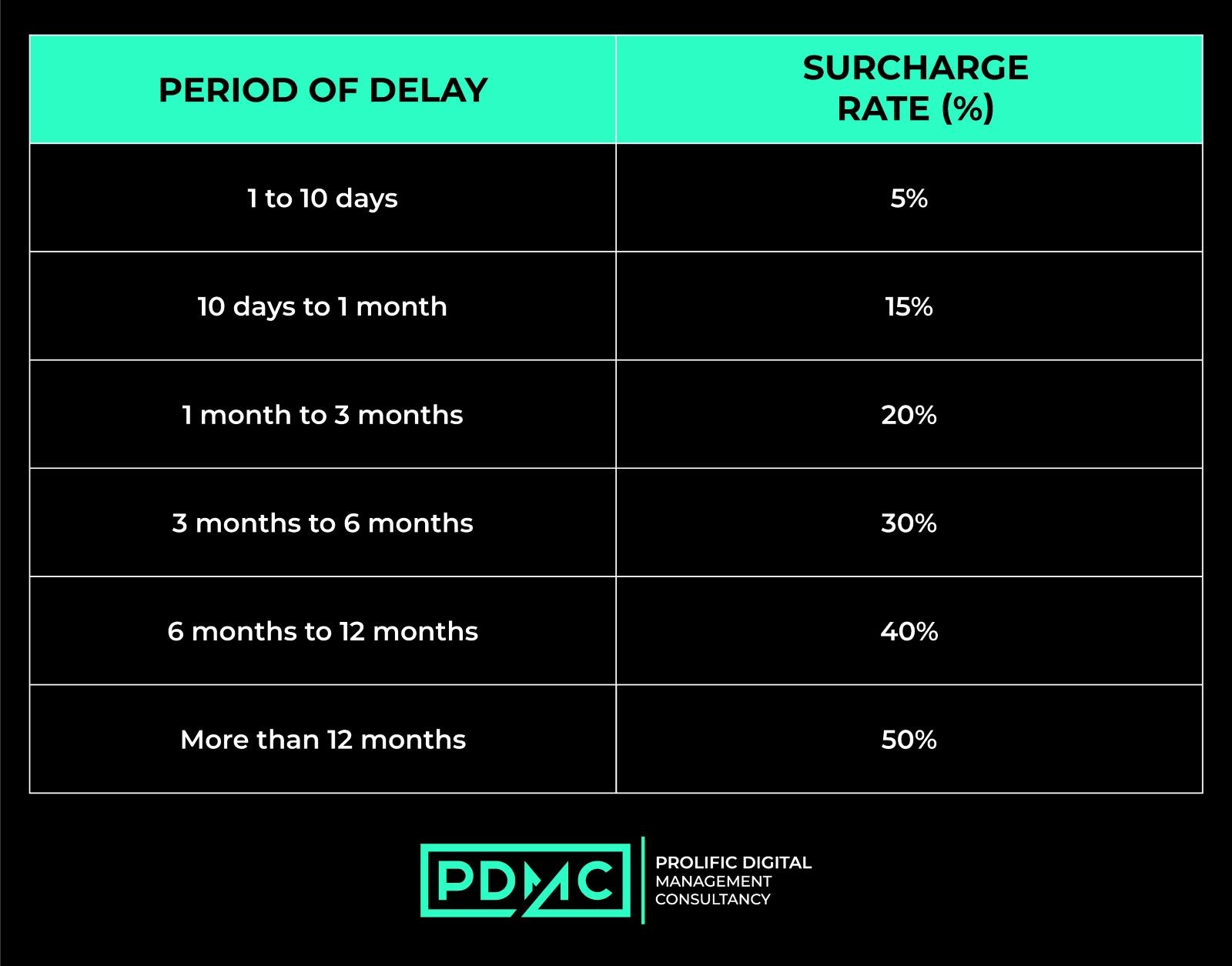

Deadline for EPF Payment and Surcharges

Employers are required to pay monthly EPF contributions to the Employees’ Provident Fund Department of the Central Bank of Sri Lanka not later than the last working day of the subsequent month. If this deadline is not met then penalties are incurred that can add a lot more to the amount that is due.

This means that not only are surcharges given for late payments, but also underpayments. Where the contribution paid is below the required amount, a surcharge will be calculated based on the number of days it will take to clear the balance.

The surcharges for delayed or incomplete payments are structured as follows:

5% for delays of 1 to 10 days

15% for delays of 10 days to 1 month

20% for delays of 1 month to 3 months

30% for delays of 3 months to 6 months

40% for delays of 6 months to 12 months

50% for delays exceeding 12 months

These surcharges emphasize the importance of timely and accurate payments. Employers must be vigilant in adhering to deadlines to avoid these penalties, which can add a significant financial burden to their operations. Understanding and respecting the payment timeline is crucial for staying compliant with EPF regulations and protecting the financial well-being of employees.

Claiming Process for EPF

The Employees’ Provident Fund (EPF) has provided several situations in which a member can withdraw his/her contributions. Knowledge of these conditions and adherence to the right process makes the withdrawal process to be efficient.

Members can claim EPF benefits in the following cases:

Retirement: Male members can withdraw their EPF once they attain the age of 55 years while female members can do so at the age of 50 years.

Marriage (for females): The female members who are married and have left employment within five years of marriage and get married within three months of leaving service can withdraw their EPF.

Permanent Immigration: EPF can be withdrawn by members who move to another country with a permanent visa to reside there permanently.

Permanent Incapacity: If a member is certified by a doctor to be permanently disabled and incapable of working, he or she can withdraw his or her EPF.

Switching to Pensionable Employment: Any member who exits covered employment to join pensionable public service or local government employment is entitled to withdraw his EPF.

To start the claim process, members are required to complete Form K enclose it with the necessary documents and take it to the nearest district labour office. It is important to make sure that all the paperwork is done properly and all the necessary forms are filled in correctly.

These steps enable members to easily access their savings to cater for important milestones in their lives such as retirement, migration or in case of disability.

Employee Trust Fund

The Employees’ Trust Fund (ETF) was created by Act No. 46 of 1980 and the operation of ETF started in March 1981. Originally, it was under the Ministry of Labour but now it is under the Ministry of Finance, Economic Stabilization, and National Policy. The ETF is a welfare fund for government employees and other employees of the private sector who are not entitled to a government pension. While in the Employees’ Provident Fund (EPF), both the employer and the employee make their contributions, the ETF only requires the employer to contribute. Employers are mandated to remit 3% of their employees’ gross monthly earnings to the ETF, providing a non-contributory benefit for the employees.

The primary purpose of the ETF is to offer welfare benefits to members without requiring them to make any financial contributions. Currently, the ETF provides nine different benefit schemes, including scholarships, life and disability insurance, financial assistance for surgeries, and housing loans. These benefits are offered without deducting any amount from the members’ accounts, ensuring that members still receive the full interest and dividends credited annually.

Besides these welfare schemes, the ETF Board has several important roles to play, including mobilising contributions from employers, soundly investing the funds, keeping membership accounts, providing annual statements and declaring dividends based on the profitability of the fund. The Board also has the responsibility of identifying employers who do not meet the contribution requirement and taking legal action against them.

In conclusion, the ETF has a significant role in improving the financial status of Sri Lankan workers by providing non-contributory benefits that meet the workers’ needs both in the short term and the long term.

Eligibility of ETF

The Employees’ Trust Fund (ETF) does not require a separate registration process for employers. Once an employer makes the first contribution and provides the Employees’ Provident Fund (EPF) number, they are automatically enrolled in the ETF.

The obligation to pay contributions applies broadly across various sectors, except for those that fall under specific exemptions.

Employers Required to Pay ETF Contributions:

Public Sector Undertakings: Any employer in the public sector enterprise where the employees are not covered under the government pension plan.

Private Sector Employers: Every employer in the private sector including those with one or more employees is required to contribute to the ETF.

Employers with Approved Provident Accounts: Public and private sector organisations maintaining approved provident funds for their employees are also required to pay ETF contributions.

Organisations and Individuals Exempt from Paying ETF Contributions:

Domestic Servants: Employers of domestic workers in individual households are exempt from contributing.

Social Service Institutions: Organizations offering training to orphans or operating as charitable institutions with fewer than 10 employees are exempt, though they become liable once they exceed 10 employees.

Family-Operated Businesses: Institutions run strictly for family purposes are not required to pay ETF contributions.

Technical Training Institutes for Orphans and the Deaf: Institutions focused on providing technical skills to disadvantaged groups like orphans and the hearing-impaired are also exempt.

Exceptions to the ETF Act:

Government and Provincial Government Employees: The Act does not apply to government employees except those who are not eligible for the government pension scheme.

Firms with Only Directors and Partners as Members: Companies with directors and partners as the only members who are not employees of the company are not subject to the ETF Act.

These conditions of eligibility help to make the ETF as comprehensive as possible to provide monetary assistance and welfare benefits to employees who may not be covered by pension or social security.

Calculate and Pay ETF

Calculate

Employers are solely responsible for making contributions to the Employees’ Trust Fund (ETF) for all their employees. Importantly, these contributions should not be deducted from employees’ wages; they are a separate obligation for the employer. The calculation of contributions is based on the total earnings of the employee, which include various components such as:

Salaries, wages, or fees

Living expenses allowances, special living expenses allowances, and similar benefits

The financial value of food provided by the employer, as determined by the Labor Commissioner

Food allowances

Gratuities and other monetary or in-kind benefits, such as commissions, piece-rate payments, and contract payments

Contribution Rate: The employer is required to contribute 3% of the employee’s total monthly earnings. This percentage applies across all components of the total earnings and is not deducted from the employee’s pay.

Employer Categories: Employers are categorised into two groups based on their workforce size:

Large Headcount Category: Employers with 15 or more employees

Small Headcount Category: Employers with fewer than 15 employees

Methods of Payment:

Manual Remittance: Contributions can be made manually through cheques, cash, or money orders. Employers must submit the payments along with duplicate R1/R4 remittance notices, which are filled out and dated. A copy of this remittance notice is returned to the employer as proof of payment. Employers using this method must also submit employee details through Form II reports semi-annually.

Electronic Remittance: The Employees’ Trust Fund Board has simplified the payment process by introducing e-banking. Employers can now make payments and submit employee details online, 24/7, from any location. This service is available to account holders of major banks such as Bank of Ceylon, People’s Bank, Commercial Bank, Hatton National Bank, Sampath Bank, and National Development Bank.

This is because the payment structure of the ETF is flexible and the guidelines on contribution are well defined hence making it easy for employers to fulfill their part and ensure that employees are provided with what they are legally entitled to.

Deadline and Surcharges of ETF

The Employees’ Trust Fund (ETF) must be made by employers and must be made not later than the last working day of the month following the contribution period. It is important to meet this deadline because if the company fails to do so, they are charged some extra amount which if not paid, adds up over time.

The surcharge structure is as follows:

5%: For delays not exceeding 10 days

15%: For delays between 11 days and 1 month

20%: For delays between 1 month and 3 months

30%: For delays between 3 months and 6 months

40%: For delays between 6 months and 12 months

50%: For delays exceeding 12 months

These surcharges are computed on the total unpaid contributions, which put significant financial pressure on the employers who fail to meet the deadlines. The severe penalty system also underlines the necessity of making payments on time so that employees do not experience any delays in receiving the benefits they are supposed to.

Employers should ensure that they remit ETF contributions every month so that they do not incur extra costs and are within the law. The availability of both manual and electronic remittance methods is advantageous to employers since they can decide on the most appropriate method that they can use for their remittance while at the same time observing the required time frame.

Claiming Process for ETF

ETF is different from the EPF in that it does not compel its members to retire before they can withdraw their balance in the fund. However, the members are required to meet some conditions before they can be allowed to redeem their ETF balance.

Key Points to Consider Before Applying:

One has to lose his/her employment before he/she can apply for a refund of the ETF. Some of the causes of termination may be retirement, resignation, dismissal or leaving the job.

A member cannot apply for the withdrawal of their ETF balance until five years have passed since the employment termination date, except under the following circumstances:

Reaching the age of 60

Moving abroad for permanent residency

Joining government service with a pension scheme

Termination of employment due to permanent disability

Death of the member

Steps for Eligible Members to Apply for Withdrawal:

Filling the Application: The withdrawal application form must be completed with clear and accurate details, such as the member's name, address, and bank account information.

Separate Application for Each Employment: If the member holds multiple jobs, a separate application form is required for each employment.

Bank Account Requirement: The member must have a bank account in their name or a family member’s name.

Supporting Documents: Attach a certified copy of the bank passbook or a bank report containing the name, branch, account number, address, and National Identity Card (NIC) number of the account holder. This document must be certified by the employer.

NIC Certification: Provide the member with NIC and be provided with a certified copy of the same.

Name Discrepancies: In the case where the member’s name is different in the application, the annual membership report, NIC or the bank account, the employer must write a letter confirming that all the names belong to the same person.

Adhering to these guidelines makes it possible to have a smooth and efficient withdrawal process of ETF hence enabling the members to access their funds easily.

FAQs

What documents need to be submitted for a Name or/and NIC amendment in EPF & ETF?

A request letter from the Employer

Certified Copy of NIC

Certified Copy of “B” Card

What should a member do, if he/she gets to know that the employer has not correctly credited EPF / ETF contributions?

Member should immediately make a formal complaint to the Department of Labour and ETF board.

What are the purposes of obtaining EPF 30% pre-benefits?

EPF 30% pre-benefits will be paid for housing purposes or medical treatments only.

Is it mandatory to withdraw funds immediately after attaining the retirement age?

No, can apply at your convenience

Are EPF refunds taxable?

No, EPF refunds are non-taxable.

What are the documents to be submitted to the Labour Department to request a refund?

The eligible applicant should duly fill and submit a Form “K” along with the “B” card to the nearest Labour Office.

What is the “Five Year Rule” in ETF?

Once a withdrawal is obtained, a member has to wait for five years from the date of cessation of employment relating to the last refund claim to make another withdrawal even if the employment changed.

How can a member obtain a housing loan under the ‘Viyana’ Housing Loan Scheme in ETF?

Loans are granted by NDB Bank subject to terms and conditions agreed upon with the ETF Board. The basic requirements for this benefit are having a minimum of five years of continuous membership with the ETF and having the required balance in the member’s account. More details can be obtained from NDB Bank.

Understanding and managing EPF and ETF contributions is vital for both employers and employees to secure a stable financial future. Compliance with regulations, timely payments, and following the correct claiming procedures are key aspects that ensure smooth operations and avoid penalties. At PDMC Solutions, we are here to support you in navigating these processes efficiently. Whether you need assistance with registrations, contributions, or claim management, our expertise can make it easier. Reach out to us today and let us help you stay compliant and safeguard your financial interests.