Blog

Gratuity in Sri Lanka: Calculation & key insights

14 Aug 2024

Gratuity, a vital element of employee compensation in Sri Lanka, acts as a financial "Thank you" gift from employers to employees for their dedicated service. Mandated by labour law, this lump sum payment is given upon termination of employment, rewarding employees who have completed at least five years of continuous service.

Although typically paid at retirement, gratuity can also be provided earlier if certain conditions are met. As proposed changes in the Employment Law Bill bring this topic to the forefront, both employers and employees need to understand gratuity's implications.

This chapter delves into the importance of gratuity, the criteria for its payment, and the potential legislative changes that could impact this benefit.

Legislation Governs Sri Lankan Gratuities

The Payment of Gratuity Act No. 12 of 1983, which took effect on March 31, 1983, governs gratuity payments in Sri Lanka. The Act applies to all employees who have completed a minimum of five years of continuous service in an organisation, whether permanent, temporary, or contract.

Eligibility Criteria for Gratuity Payments

To be eligible for the gratuity, an employee must have worked in an establishment employing 15 or more employees during the 12 months before layoff or termination and must have completed at least five years of continuous service under the same employer. However, if an employee dies before completing five years, becomes disabled or retires due to ill health, they may still be entitled to gratuity.

Also, this Act does not apply to employees who are employed as domestic workers in a private household or as private drivers or who are entitled to a pension under any pension scheme to which they do not contribute.

Base Salary for Gratuity Calculation

Many people are curious about the salary that is used to pay the gratuity. It is unclear whether the basic salary of the last month of work the gross salary of the last month of work or the net salary is the basis for payment of gratuity.

According to the Payment of Gratuity Act No. 12 of 1983, the base salary for gratuity is defined as "the amount of salary obtained after adding the living allowance, special living allowance or other similar allowance given to the employee to the basic or combined salary or remuneration".

Here, living allowance and special living allowance are defined as the two types of allowances under the Budgetary Relief Allowance Act No. 36 of 2005 and Budgetary Relief Allowance Act No. 4 of 2016.

Gratuity Payment Calculation

Payment of Gratuity Act No. 12 of 1983 has 2 sections dealing with payment.

The first part deals with the land acquired under the Land Reforms Commission and the payment of gratuities to the workers who worked on them. As this is not currently in force, we will not pay attention to it.

At present, payment of gratuity is clearly stated in Part II of the Payment of Gratuity Act No. 12 of 1983.

There are 3 types of gratuity payments to employees, so we pay attention to them in detail.

1. How to pay gratuity to an employee who receives a monthly salary

In this case, the amount received by the eligible employee, divided by 2 of the last "base salary for gratuity", multiplied by the number of years the employee has worked continuously, should be paid by the employee as gratuity.

For example, an employee who has a basic salary of 35,000.00 rupees, Budgetary Relief Allowance Act No. 4 of 2016 is eligible for Rs. 2,500.00. So the base salary for this employee's gratuity is 37,500.00 rupees. Assuming that this employee has worked continuously for 5 years and 9 months, the calculation is done as follows.

Gratuity = Rs. (37,500/2) * 5 = Rs. 93,750

Here, only the number of years completed by him is used for the gratuity.

2. Manner of payment of gratuity to a daily salaried employee

In this case, the amount received by the eligible employee in the last 14 days of "base salary for gratuity", multiplied by the number of years of continuous service of the employee, shall be paid to the employee as a gratuity by the employer.

For example, an employee who earns Rs. 1,000.00 per day is eligible for Rs. 40.00 per day for Budgetary Relief Allowance Act No. 36 of 2005 and Rs. 100.00 per day for Budgetary Relief Allowance Act No. 4 of 2016. So this employee for the last 14 days (assuming that he has not taken leave on any day) is 15,960.00 rupees. If it is assumed that this employee worked continuously for 10 years and 5 months, the calculation is done as follows.

Gratuity = Rs. 15,960 * 10 =Rs. 159,600

3. Manner of payment of gratuity to an employee on piecework

Here the eligible employee should calculate the salary received for the last 3 months and get the average earned by him per day. One day's salary should be multiplied by 14 to get 14 days' salary. The amount received by multiplying the salary received by the employee by the number of years of continuous service shall be paid by the employee as gratuity.

For example, suppose the employee received a salary of 165,000 rupees for 3 months. In that case, an employee whose daily salary is 1,833.33 rupees is not eligible for Budgetary Relief Allowance Act No 36 of 2005 and Budgetary Relief Allowance Act No 4 of 2016. So the "base salary for Gratuity" of this employee is 25,666.62 rupees. Assuming that this employee has worked continuously for 6 years and 3 months, the calculation is done as follows.

Gratuity = Rs. (1,833.33 *14) * 6 = Rs. 153,999.72

Taxation on Gratuity Payments in Sri Lanka

According to the Inland Revenue Act of Sri Lanka, gratuity payments are subject to income tax. However, a tax exemption is provided for the first Rs.5 million. Any amount above this limit is subject to tax. The percentage is 12%.

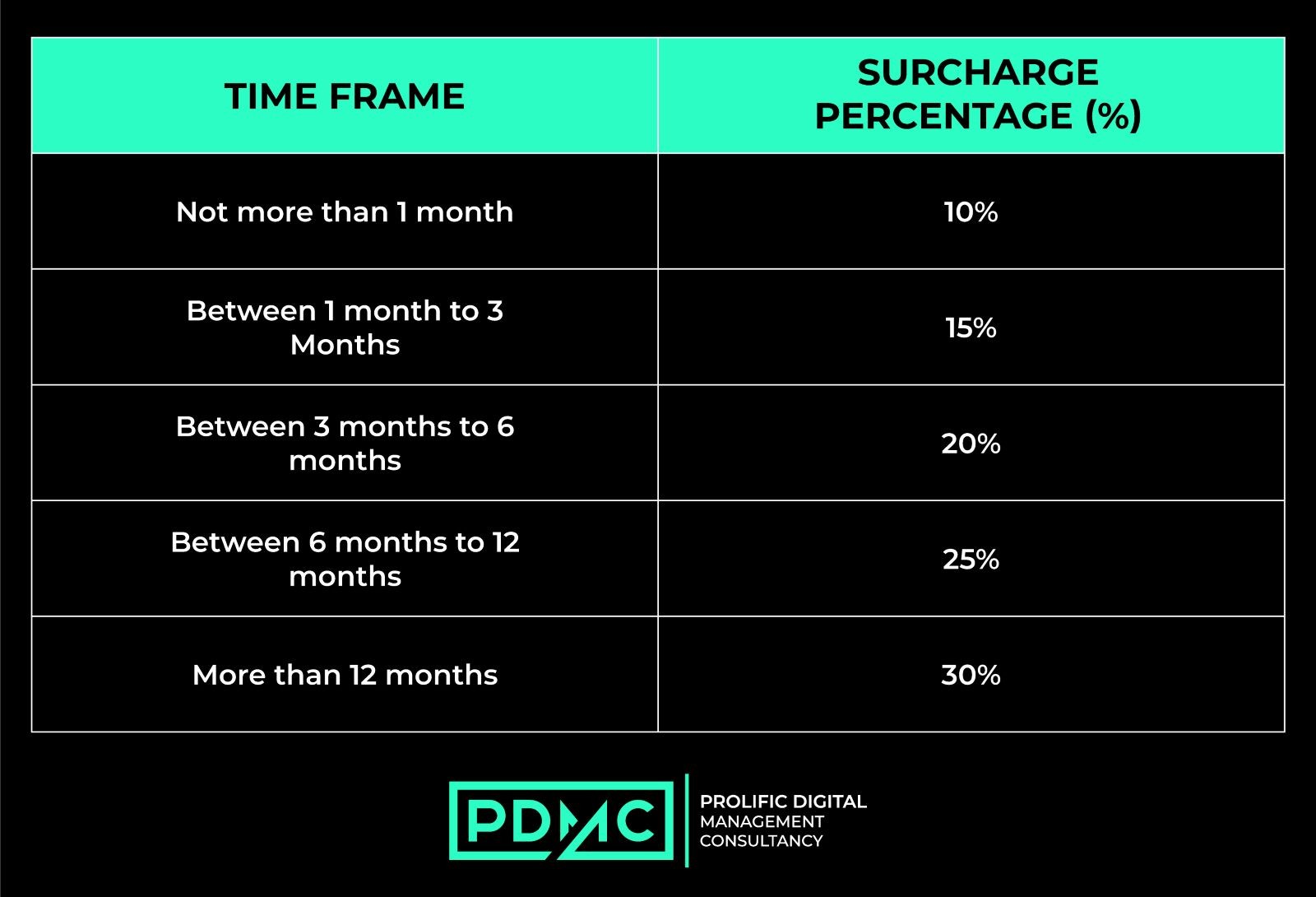

Gratuity Payment Deadlines and Penalties

Employers are responsible for paying gratuity to eligible employees within 30 days of their termination. However, it is common for employers to pay gratuity upon the employee's retirement or resignation rather than waiting for the full 30 days. If there is any dispute regarding the payment of gratuity, an employee can file a complaint with the Labor Commissioner or take legal action through the Labor Tribunal. And in the Gratuity Payment Act itself, the penalties imposed on employers who do not make payments on time have also been mentioned. We need to be aware of those.

Frequently Asked Questions (FAQs)

How long does it take the employer to release the gratuity money?

Within 30 days of the termination date, it becomes payable.

Is it compulsory to complete five years of continuous service to apply for gratuity?

Yes, it is compulsory to complete five years of continuous service to apply for gratuity.

What is the difference between a Provident Fund and Gratuity?

A Provident Fund (PF) account involves contributions from both the employer and the employee. Conversely, gratuity does not incorporate any contribution from the employee.

If I resign from a company after 4.5 years of service, am I eligible for gratuity?

No. To be eligible for a gratuity, you must have worked continuously for at least five years.

What is the process for claiming gratuity after retirement or leaving a job?

Employees submit a written application to their employers mentioning important details like service terms, last drawn salary, and reason for leaving. After the approval of the application, the employer processes the employee’s claims.

Thus, it can be stated that understanding the specifics of gratuity in Sri Lanka is crucial for both, the employers and the employees. Computation of the gratuity and its payment within the required time not only meets the requirements of the Payment of Gratuity Act but also helps in building up trust and appreciation in the organization. Companies that stick to these regulations make sure that their employees are appreciated and respected for their years of service hence creating a positive attitude towards their job among their employees.

Gratuities must be well managed to avoid any legal implications and should be processed accurately and within the right time. If all these aspects of gratuity calculation and payment seem quite cumbersome, then it is advisable to consult a professional or seek legal advice to avoid falling foul of the law.

If you require professional assistance with gratuity payments or other payroll issues, you are welcome to contact PDMC Solutions and receive a free consultation to make sure your company complies with the law and your employees are happy.